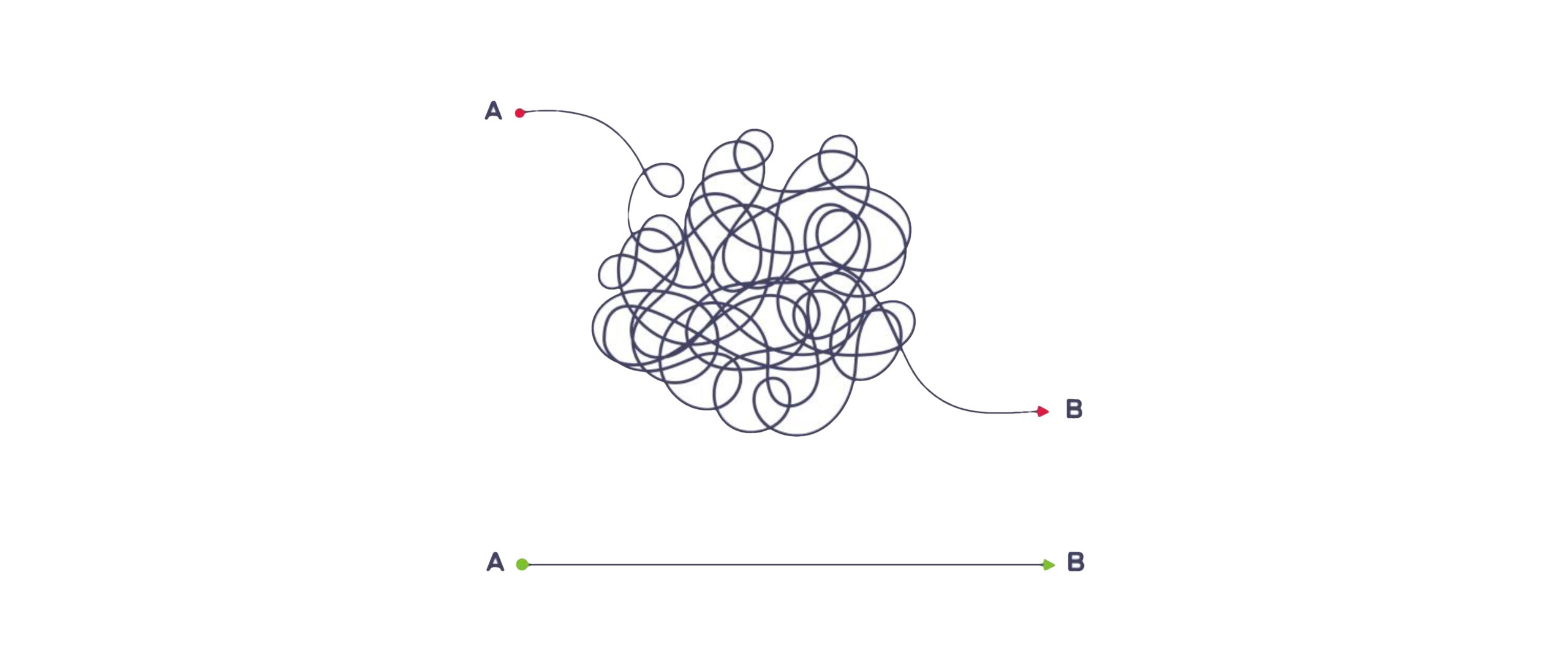

Going through a merger or aligning several companies under one brand umbrella can be tricky in any industry. In theory, mergers are a great way to unlock greater value and provide customers with a more robust service offer. However, a great number of M&As end in failure or become a major pain until they gather traction. Here at Zeile7, we have identified seven areas that can tip the scale towards success.

How will value be created? How are the new (sales) targets going to look? What systems will align data and support the processes in the new venture? What is the culture going to be? What are the values that support all of the above? This is less of an intellectual and more of a listening, hearing and understanding exercise. In other words, answering the questions above top-down works well here, but based on a deep and attentive look at existing systems in place. This provides the bottom-up data-driven support to aligning the value of merging organisations. For example, this helps understand whether there is an overlap in customer base or how to balance transactional vs strategic sales. Strong leadership is key here. Pick A-players from the merging companies and put them in charge of the overall integration effort. Do this EARLY, soon after the announcement or even before. There is often a drop in sales after a deal is announced – the Leadership Committee needs to ensure the sales of each company are preserved, and upselling opportunities are identified. They are 100% owners, 100% accountable, full-time and with appropriate seniority to carry out the integration. The Leadership Committee members play that role for a defined period, but on a high-level. Tempted to focus purely on commercial alignment? Don’t – go beyond! Take into account culture, operations & technology. Whatever the key success drivers are, have your A-player representing it in this Leadership Committee. The team needs to be deeply networked within the organisations merging.

This is the reason why you do an M&A in the first place – you seek to combine the strengths of two or more companies. Protect existing and drive new revenue. The key to drive revenue after a M&A is cross-selling. This happens when the CRMs or ERPs of the merging companies are integrated (and fails when they are not). Aligning processes and the systems that support them ensures customers get all of the value and none of the mess. If a salesperson can bank on their relationship with an existing customer to upsell fabulous new products, revenue goes up. If a customer gets a new salesperson assigned, who knows nothing of the previous sales history and blindly pushes unsuitable products – the customer is more often than not lost.

Losing your best talent during a M&A is one of the most important causes of revenue loss. If employees feel the differences in growth opportunities, core values, management style, or innovation drive will decrease their job satisfaction, they are more likely to be captured by competitors. Identify and engage key talent, and not only in the sales/tech department, but also in all the supporting functions – the enablers. Help them be optimistic about the combined business, build an atmosphere of expectation about the combined collective ideas, spirit, and values. With change comes anxiety that can be calmed with a clearly communicated plan. Make sure to get help in crafting the right tone and language when driving the change.

Model the new culture from the top – the support is not only for employees, the leadership also needs someone to lower the noise and stress of a M&A. Having a strong project manager supporting your A-players Leadership Committee will help establish clear authority lines, frequent and clear communication and greater overall stability. This is critical when the cultural differences between the merging companies are addressed. Culture is in the minds of employees, but also in the practices and processes. It is in the priorities for the Sales teams and the way the tech teams are managed. A thorough analysis of these culture repositories will provide you with a solid base, on which to launch the new culture. Pitching change when you show familiarity and understanding of the cultures of all merging companies, gives you stronger credibility. It also makes people feel supported.

Preserve existing revenue, merging the CRM tools. This will ensure overlapping customer accounts and sales territories are resolved. It will allow for an easier review of quotas and targets, territories and assignments. Again, a combined customer database is critical as your customers are your true north. Communication: clear, relevant, timely, repeated 7 times, on 7 different channels. Open a specific channel with customers to reassure them the company is focused and engaged, that there will be no disruption to services. For some industries, a customer advisory board may be a good idea during the integration planning and execution. You want to give customers a voice, before it gets into your social media and snowballs into a comms disaster.

Have clarity about what you want and be honest with your management team. Whatever it is, make sure you are advised by experienced M&A professionals. M&As are stressful and happen in a lot of uncertainty. You must feel comfortable asking all your questions and feel able to walk away if you are not happy about the answers. Believe it or not, this makes you a better negotiator. Make sure you have help supporting your back with data, impartial advice and a board to bounce ideas off.

This is beyond game theory – it is enlarging the pie. At a successful merger, everyone must walk away better off – the companies, the customers, the industry and the society. Keeping the bigger picture in mind helps – keeping several scenarios of the bigger picture is even better. Some decisions will not feel right if you extrapolate the future as equal to the past. However, when everyone allows themselves to think of alternative futures, it becomes easier to get to an agreement. To help you change your mental models about the future, scenario planning is a great tool. Its broad trend analysis foundation helps you see more clearly the deal amount in context. It can help negotiations re-define the M&A value, perhaps turning the merger offer into a competitive deal. It helps evaluate a broad range of alternatives, and how they may play in different future scenarios. In other words, scenario planning guides you through a mental exercise of considering your options in a variety of combinations of market dynamics and larger global forces.